Governance & Documents

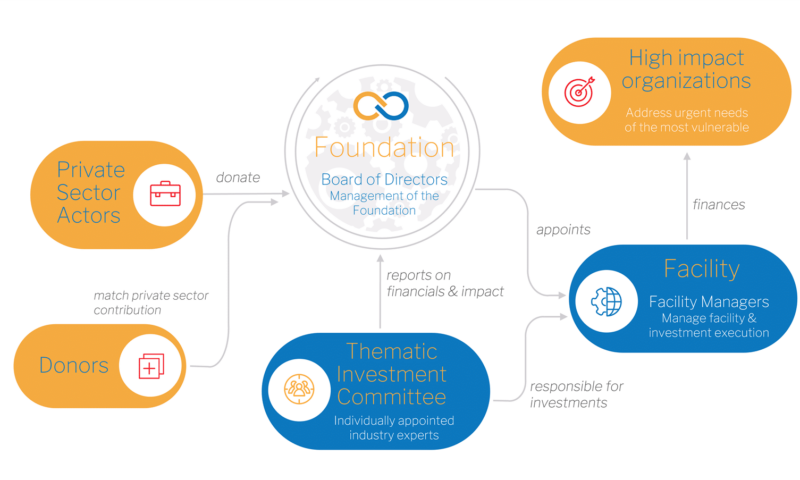

The Impact-Linked Finance Fund is set up as a Dutch foundation (“Stichting”) registered at the trade register under 34333546. Its governance structure is designed to safeguard its mission to provide finance to high-impact organizations and reward them for positive outcomes generated through their business activities as well as the financial and commercial sustainability of the Fund.

For more details on governance, please click on the tables below:

Our guiding values

The Foundation adheres to the following guiding values:

(1) Effectiveness:

We strongly believe that the impact performance of an enterprise can be affected by the way in which it is financed. We apply the Design Principles for Impact-Linked Finance in order to ensure maximum additionality and promote the most effective use of funds and engage in further development of these principles and its broader application in the field.

(2) Transparency:

We apply highest transparency standards across the whole process from selection, structuring of financial transactions and outcomes to verification. We regularly share information and relevant indicators with the Advisory Board and the Investment Committee in order to get guidance and support.

(3) Verification:

The verification of impact will go beyond process validation of outcomes and include the contribution of the financing for the enterprise and the broader impact of its activities including unintended effects whenever possible and feasible.

(4) Innovation:

We believe in the idea of “better terms for better impact” and advocate for applying this approach across business, policy and finance. We are committed to contribute to the field by sharing lessons learned and good practice as well as providing support to other actors engaging in Impact-Linked Finance.

(5) Inclusiveness:

We actively seek input and feedback from our stakeholders, in particular beneficiaries and organizations supported by the Foundation.

Roles & responsibilities

Overall responsibilities for the management of the Foundation rests with the Board of Directors in accordance with the Articles of Association, as outlined in more detail below.

The Board appoints a Facility Manager for each dedicated fund as well as (in collaboration with funders) a Thematic Investment Committee which will take the final investment decisions based on the recommendations of the Facility Manager. Details about investment decision-making, impact measurement & management as well as investment reporting can be found in the General Investment Policy & Guideline.