The Impact-Linked Finance Fund (ILFF) is the specialized service provider for Impact-Linked Fund Managers.

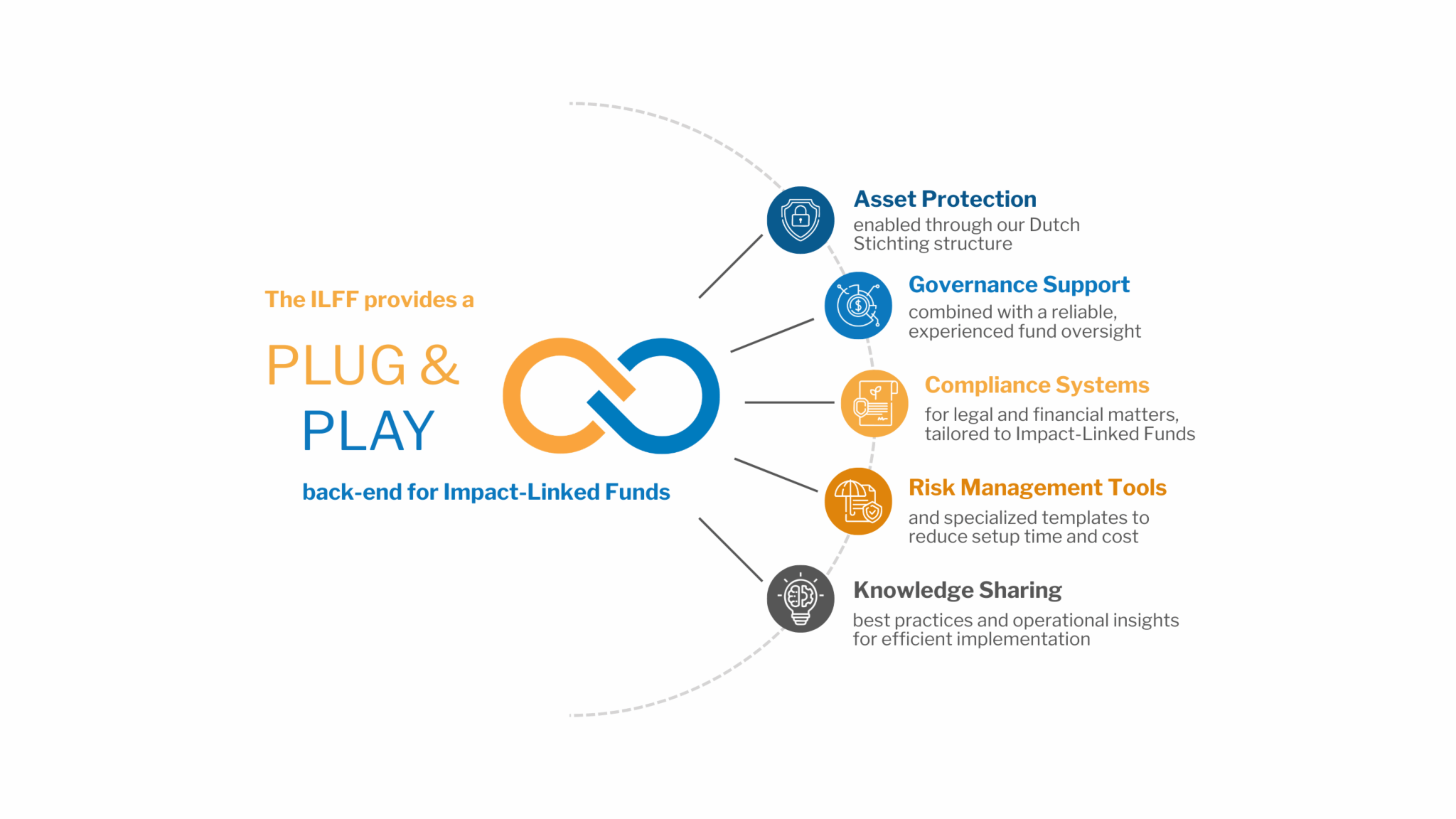

As your plug-and-play implementation partner, we provide you with an operational, legal, and financial back-end infrastructure that is compliant, reliable and tailored to the needs of your Impact-Linked Finance programs.

Which operational services we offer:

The ILFF provides a plug-and-play back-end for deploying Impact-Linked Funds.

Who is behind the ILFF:

The Impact-Linked Finance Fund (ILFF) was established by ROOTS OF IMPACT and IGRAVITY in 2021 to combine their operational experience in enabling scalable Impact-Linked Funds. The ILFF is structured as a Dutch foundation and operates as a back-end service platform for Impact-Linked Fund Managers. Through its services, ILFF helps ILF Fund Managers manage compliance, fiduciary controls, and operational processes — enabling them to focus on delivering impact.

Our mission is to provide the infrastructure that supports Impact-Linked Funds in unlocking private capital for high-impact enterprises. Several IMPACT-LINKED FUNDS illustrate our ability to successfully manage compliance and complexity and ensure cost-efficiency on behalf of our fund management clients.

What Impact-Linked Fund Managers say about us:

The ILFF is proud to support leading funders and fund managers by providing the operational infrastructure behind their Impact-Linked Finance initiatives. Below are some reflections from our back-end users.

We are pleased to get you started!

We are excited to answer your questions anytime. REACH OUT TO US to talk about your operational needs in a short introduction call. If you would like to dive into some typical questions and answers around our services, visit our FAQ PAGE or check out our GOVERNANCE PAGE to understand our legal structure and fiduciary responsibilities.

“The ILF platform is a cornerstone for us to deliver our Impact-Linked Finance mandates in an efficient, professional, and seamless way. It is now open to third parties, offering a plug-and-play solution that enables them to benefit from proven tools and infrastructure.”

“The ILF platform is a cornerstone for us to deliver our Impact-Linked Finance mandates in an efficient, professional, and seamless way. It is now open to third parties, offering a plug-and-play solution that enables them to benefit from proven tools and infrastructure.”